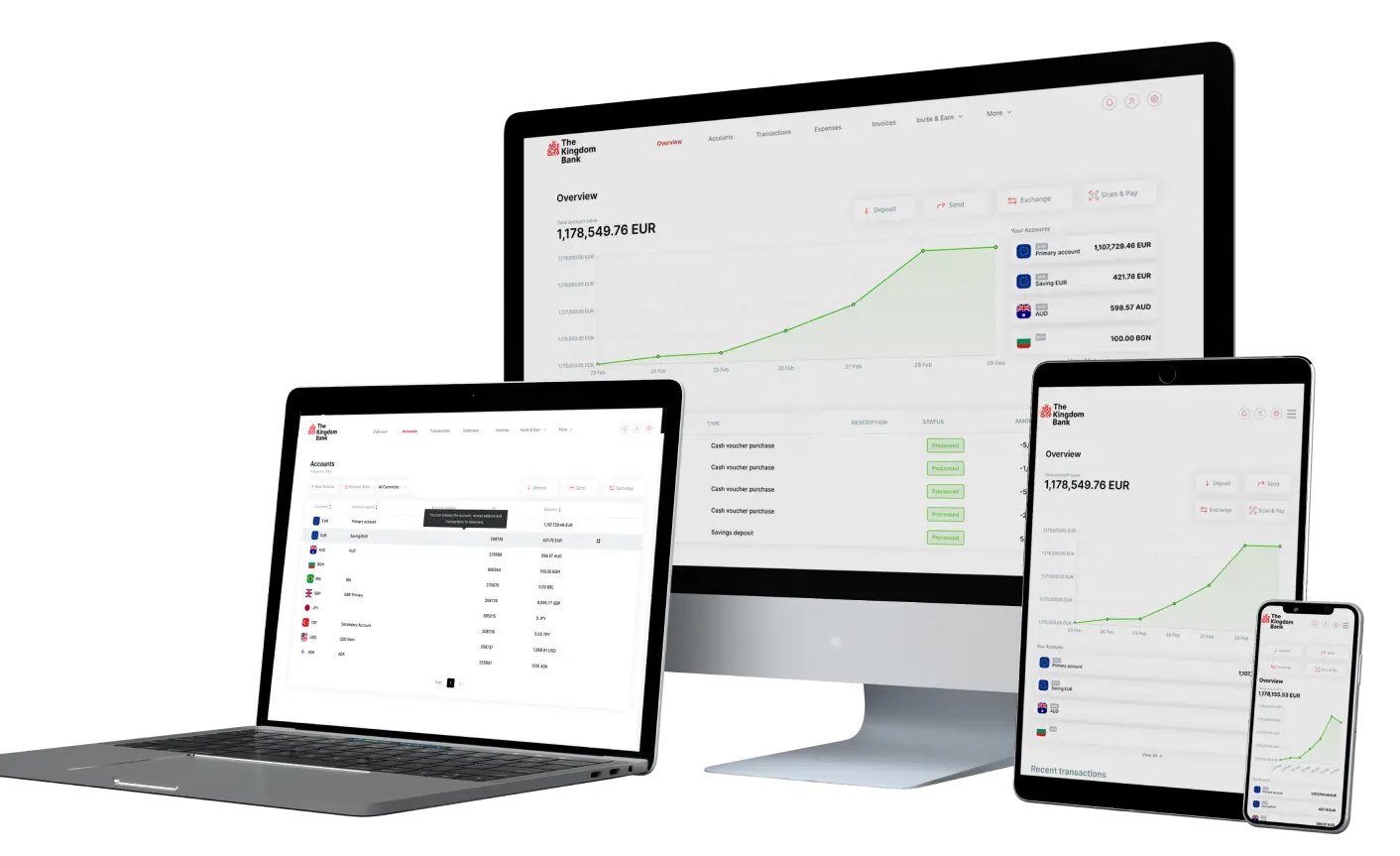

Since our founding, The Kingdom Bank has set out to lead the transformation of the financial world. In a short period, we have successfully established a reliable, innovative, and robust financial ecosystem.

Today, with our active service in over 80 countries and nearly 500 employees worldwide, we create value in the areas of technology, operations, compliance, and customer experience.

Stepping Into the New Year with Momentum

As we move into the new year, we are focused on expanding our global reach, strengthening our leadership in digital banking and fintech solutions, and further enhancing the multi-currency and cross-border experience for businesses and institutions.

2025 was a year of meaningful progress, marked by 𝟓𝟎𝟎% 𝐠𝐫𝐨𝐰𝐭𝐡 in client adoption and transaction activity, reflecting the increasing reliance of businesses on our innovative banking solutions.

Key highlights from 2025 include:

- Introduced dedicated multi-currency IBANs (including USD, EUR and GBP), enabling account holders to send and receive payments in over 60 currencies, accept direct debits globally, and expand their international presence

- Ongoing improvements to account functionality, including enhanced expense management and payment flows

- Kicked off Apple Pay and Google Pay deposit capabilities, making account funding faster and more accessible

- Expanded card capabilities, supporting both physical and virtual use cases for businesses and individuals

- Upgraded card limits up to $1,000,000, supporting higher-value transactions and greater flexibility for business spending

- Enhanced card functionality allowing USDT spending directly via The Kingdom Bank Card

- Continued development of savings accounts with competitive interest rates on GBP, EUR, and USD

- Launched gold trading, providing access to an additional asset class for portfolio diversification

- Activated overdraft functionality across both fiat and digital asset balances, supporting short-term liquidity needs

- Enabled unlimited digital asset wallets, allowing clients to consolidate, manage, and transact across multiple wallets for a single currency

- Integrated real-time digital asset tracking within the platform with the Crypto section

- Expanded the digital asset portfolio with new coins: BCH, AVAX, TON, TRX, SHIB, ARB, and more

- Expanded service availability to 24/7 non-stop banking, ensuring access beyond traditional banking hours

- Launched The Kingdom Bank iOS App in the United Kingdom, giving clients full account management on the go

- This year, engagement went beyond banking. 2025 closed with strong participation and tangible value returned to our client base.

- Our 5% cashback campaigns rewarded active clients for everyday card usage

- The Porsche giveaway closed the year on a high note, with one of our corporate clients winning the ultimate prize

- Additional campaign rewards were distributed across multiple product categories, reinforcing our commitment to giving back

Partnerships played an important role in strengthening our ecosystem. These relationships helped extend our reach while staying focused on business-first banking.

- Continued supporting West Ham United with a stronger global partnership, connecting our brand with a global audience

- Integrated with Mastercard enabling real-time cross-border payments, connecting bank accounts, digital wallets, and global cash transactions across 90% of the world’s population

- Collaborations that supported payment acceptance, liquidity, and operational efficiency, including Binance Pay, Fireblocks and Circle Alliance.

In 2025, The Kingdom Bank remained visible and demonstrated seamless leadership at most of the crucial industry expos and events.

- Participation in major international events and industry summits like ICE, iGB and many more.

- Direct engagement with businesses across finance, trading, and digital services

Our innovative approach, robust infrastructure, and customer-centric service philosophy have repeatedly set us apart in the industry.

The Kingdom Bank's numerous awards attest not only to its financial performance but also to its service quality, technology investments, and visionary perspective.

Our 2026 Goals

At The Kingdom Bank, our 2026 goals are very clear:

- To further expand our global reach

- To strengthen our leadership in digital banking and fintech solutions

- To further enhance the user experience in multi-currency and cross-border transactions

- To raise industry standards in security, compliance, and sustainability

- In the coming period, we aim to increase our technology investments to offer smarter financial solutions, making banking more accessible, faster, and transparent for individuals and institutions.

With our solid steps to date and clear vision for the future, The Kingdom Bank continues to be more than just a bank; it remains a reliable partner in the global financial world.

To benefit from advantageous banking and explore our services, open your online banking account in just a few steps.