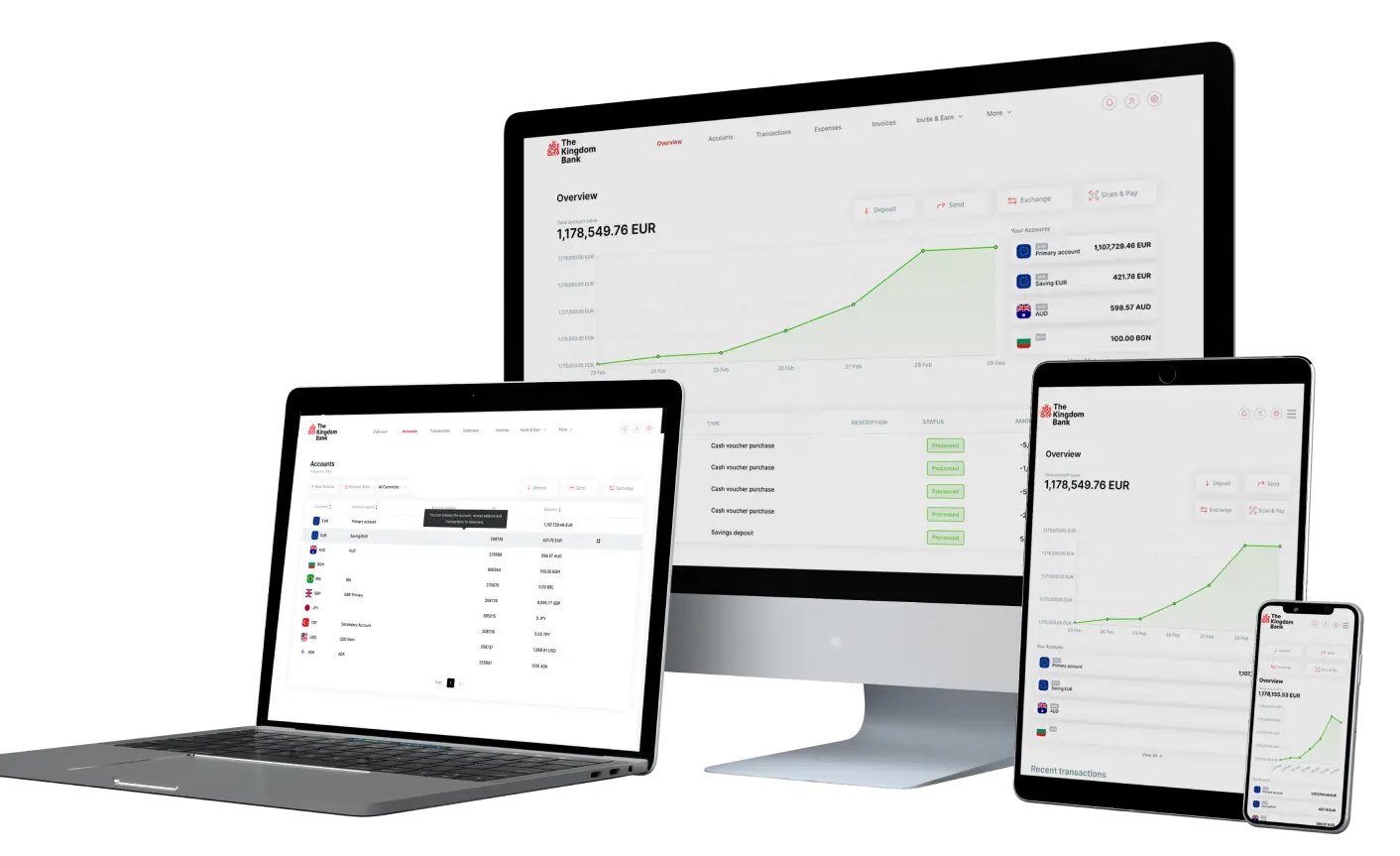

B2B banking through financial institutions facilitates transactions between corporate accounts with payment methods and services. These transactions made through electronic banking platforms also make it possible to exchange money and even digital assets between businesses.

Award-Winning Services for Today's Business World

B2B Banking Services in The Kingdom Bank

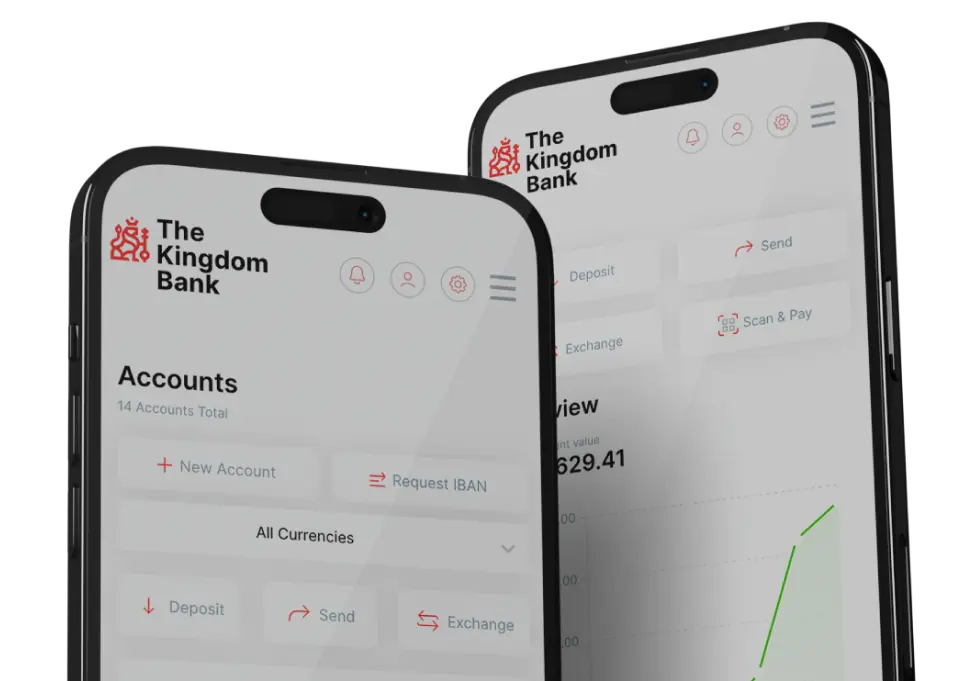

B2B banking helps businesses grow by bringing a whole new perspective to payment methods. It also accelerates international transaction processes.

B2B banking, where efficient and fast transactions are carried out, is the purchase and sale transactions carried out between more than one corporate account, at least two. B2B in digital banking is an electronic service created to facilitate commercial payments or transactions between companies or institutions and to aggregate them on a single digital platform.

Transfer money securely and instantly

What are B2B Payments?

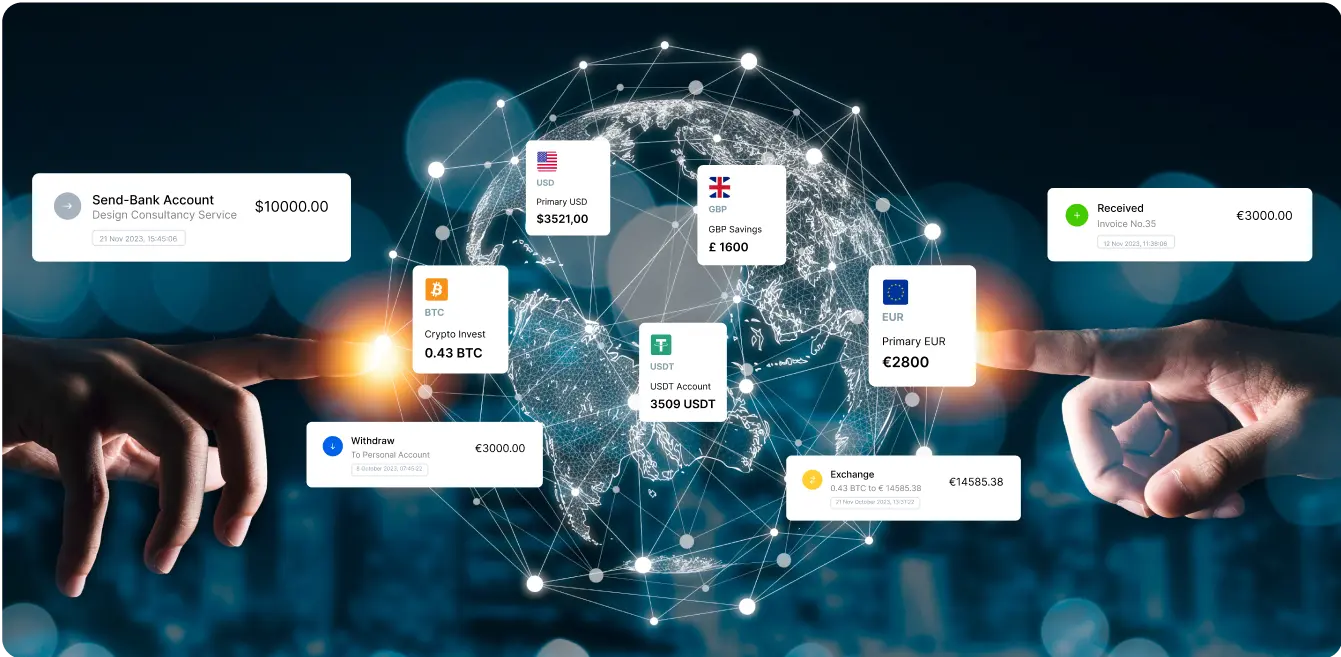

B2B payment systems are any money transfer system made between businesses. Businesses can perform financial transactions for many different reasons. For example, the invoices for the purchases can be made through digital banking, or the payments for the services provided between companies can be made through electronic banking.

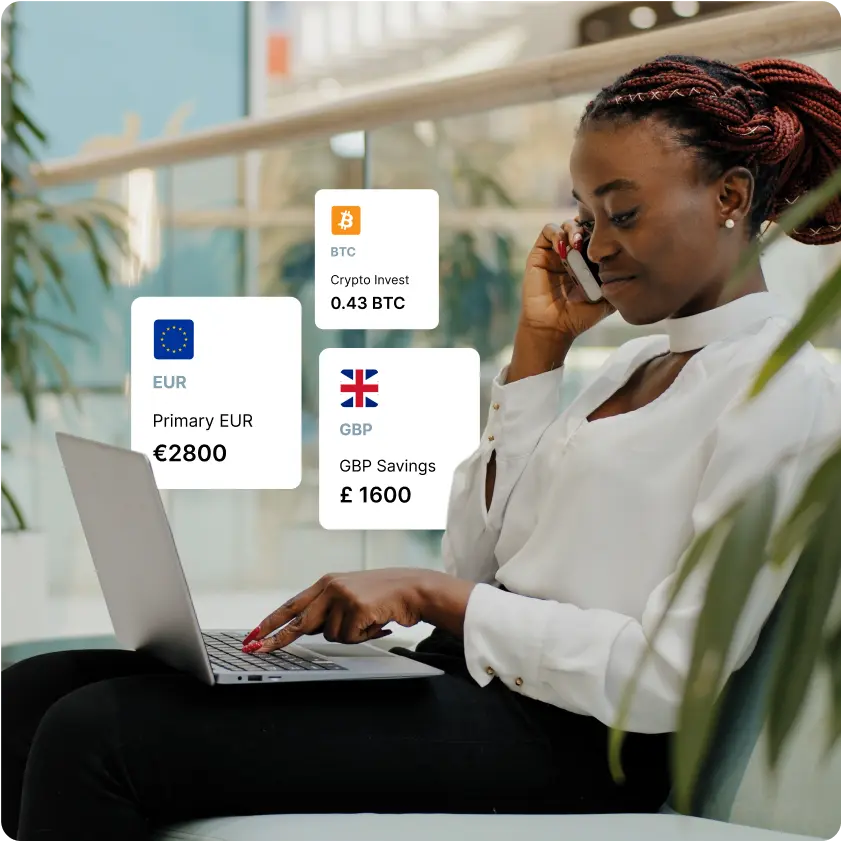

Transactions can be made not only in a single currency, but also in more than ten currencies from a single account. In this way, businesses can transfer money securely and instantly without paying extra for international B2B transactions.

Start international transactions with B2B banking.

SIGN UP NOW →