B2C PaymentsBest Payment Methods For Your Business

Forming a business from ground zero requires excellent effort, encouragement, and tons of luck. Moreover, to plan everything, to find the financial sources, and recruit an internal circle feeling the same way as you. Maybe you found yourself sitting down and thinking, "I'm done!" many times. But you saw the power in you and did not give up although all ambivalences you have passed through. Now you are here! Your e-commerce site is on your screen like a monument referring to your journey from the moment you stood up for your dreams. This is priceless!

However, you still have a long road to walk. Considering we are not only chasing the amour propre, but the indication of a prosperous business is profitability. How can you start to pick up the fruits you have planted? What is the best way to step forward in such a competitive area surrounded by high demanding customers? Is it possible to connect them continuously? This moment of Occam's razor, the simplest explanation, is usually the best one. To set up hassle-free B2C payments for your business!

What are B2C Transactions?

It would not be inaccurate to define B2C payments as the process of exchanging services or products between a business and consumers who are the end-users of subject services and products. The consumer could either be an individual or a small business at this point. Although they are mostly known as one-time payments such as rebates and refunds, limiting them with these types of B2C transactions is not wise. Because paying employees their wages or disbursements from an insurance company to its policyholders can be considered a Business-to-Customer payment. Therefore, they are crucial for stronger bonds and satisfaction between both parties; whether they are online shopping buyers, clients, or a supplier, you want to keep close bonds.

To demonstrate the importance of B2C banking solutions, we can give an example of a scenario in which your consumer requests a refund. Undoubtedly, refunds are the litmus paper when it comes to unsatisfied buyers. Are you ready to send the amount back instantly in these cases? Refunds generally take quite some time, even after the rebate is approved. Yet, a functional payment method can save both the day and your prestige in the eyes of the target market.

Why Digital Banks are the Best Solutions

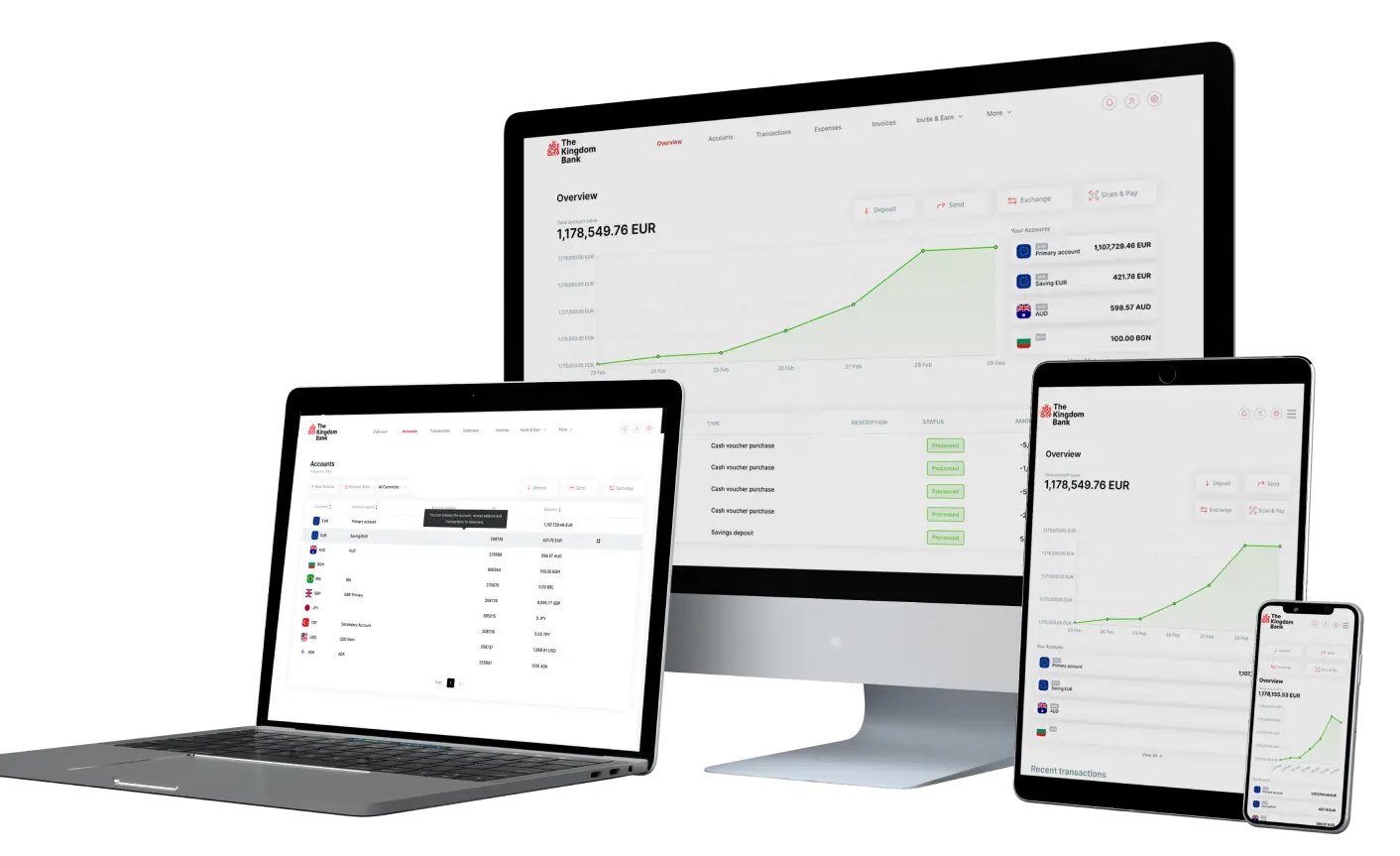

There are neither borders nor heavy regulations in the financial world today. The humble traditional banking processes are excluded by the people of the future who are reaching anything anytime. No one has time to mess with mortar-and brick banks and their time-consuming methods to control their cash flow. That's why digital banking has become popular day by day. You can monitor every single transaction in seconds through a simple application, whereas it is also a smooth process to send and receive funds.

Moreover, give access to prepare e-invoices to document your sales. This is a significant advantage for businesses because invoices are crucial to record sales. Thus, it is possible to say that everywhere with an internet connection is now a physical bank branch.

Our innovative and award-winner digital banking platform, The Kingdom Bank, welcomes small businesses, freelancers and entrepreneurs worldwide for B2C payments with no hitch. Our clients will enjoy flawless money transfers besides hassle-free offshore services. Create your The Kingdom Bank account now and carry your precious business forward beyond your dreams! The future is here. How about you?